We are on the front end of a space super cycle. It is the hidden infrastructure we rely on every day for nearly everything we do in the internet age. And governments around the world are awakening to the fact that space technologies are essential for the economy and national security. When you order an Uber, a GPS constellation in orbit enables it. Rapid, responsive launch capabilities have game-changing implications for special military operations. Extraordinary footage from Israel shows the IDF shooting down an Iranian ballistic missile outside the earth’s atmosphere. Low earth orbit (LEO) is now a critical arena of warfare. Space-based systems and technologies are a critical enabler of the vast majority of modern military capability. They provide intelligence, from early warning and global positioning systems to missile guidance. Since satellites are critical military assets, they are increasingly weaponized. Russia recently sent a ballistic missile into orbit to blow up a defunct 1982 spy satellite to prove they could do it to American space assets. The Department of Defense is investing heavily, through the U.S. Space Force (USSF) and other ventures, in the protection of assets in orbit. They plan to ramp up their space “war-fighting” capabilities enormously. NATO is increasingly focused on space as a means to maintain a qualitative military edge over Russia and China.

There is also enormous interest in Washington in setting up a long-term space station (partly driven by tensions with China). King Charles recently had an event at Buckingham Palace where he unveiled the Astra Carta, which is a declaration about sustainability in space. Space was also the major topic of conversation at the most recent G7. The space market is expected to triple to ~$1.8 trillion by 2035. Growth drivers include the need for greater satellite connectivity, higher demand for positioning and navigation for cell phones, and increased demand for AI-powered machine learning. There will be business opportunities and ventures in orbit no one can think of right now. Not to mention the possibility of future space colonization. Geopolitical analysts often emphasize superior Chinese shipbuilding capacity as definitive proof of irreversible decline in American military supremacy. But space technologies and orbit are as essential today as ships and the oceans were to Great Britain in the age of enlightenment. And the U.S. is winning the space race (thanks largely to SpaceX). Who cares about the seas if you control the heavens?

Rocket Lab (RKLB) is a founder-led, end-to-end space company valued at ~$2.65 billion. Founder, CEO and Chairman of the Board Peter Beck owns about 10%. With a track record of impressive innovation, high cash burn and quick revenue growth, it’s more like a venture capital investment than a traditional public company. Putting a valuation on it is tricky. Nuances of future industry economics are difficult to predict. They maintain a healthy balance sheet, ending Q1 with roughly $565 million in cash (largely the result of a $355 million convertible senior notes offering). Stock-based compensation (SBC) is high and it’s reliant on external funding to grow. The share count has risen by 10% since going public. While something to keep an eye on, it’s normal for high-growth, innovative companies. It’s indicative of quality employee morale and healthy demand for company equity. SBCs are a great way to keep skilled, young engineers eager. The share price has been ranging between $3 and $6 for two years. Many institutions can’t invest because the share price is too low and volatile. There is SPAC stink, memories of Virgin Galactics’ (SPCE) debacle and most importantly: the long shadow of Elon Musk.

SpaceX & Elon

SpaceX is the 800-pound gorilla. It has formidable clout, very deep pockets and a de facto monopoly over the large launch industry with their Falcon 9 rocket. The reusability SpaceX has pioneered — where rockets re-enter atmosphere and land at their launch sites — is unique amongst competitors. Starship, the newest and biggest rocket (aimed to colonize mars), will have a far lower price for hauling cargo than competitors when completed. Starship is designed to bring people and cargo to colonize mars. The elephant in the room is what commercial model will drive this. SpaceX is the primary launch provider for NASA and the Pentagon. Their rockets carry far more commercial satellites into orbit than anyone else. They have set new standards for reaching space cheaply and effectively. And they play hardball by slashing launch prices (among other things). SpaceX set the price of its Transporter services — where small satellite companies can book “rideshare” slots on a Falcon 9 — aimed at undermining competition. More ominously, Starship rates to carry a satellite into orbit could be as low as $200 a kilogram (compared to the $6,000 that SpaceX charges for its Transporter flights or the $21,500 per kilogram for Electron launches to specific orbits). Falcon 9 and Starship could dominate the launch industry for decades, with many projecting SpaceX delivering 90 percent of world cargo to space this year.

More recently, SpaceX started ‘Bandwagon’, which offers satellite makers launches to orbits. SpaceX is selling these flights far below cost, Mr. Beck estimated in a recent New York Times article about the industry. “Bandwagon is like, the most bold and obtuse anti-competitive thing you can do.” Due to Elon’s sharp elbows, rancor has spilled into public. “Whatever shady practices he wants to do along the way, then so be it — we don’t care,” Mr. Beck said. “Because at the end of the day, you have to compete. And if you can’t compete, then you can’t compete.” There is history between the two. Peter met in 2019 with Elon to talk about RKLB’s LEO launch business. Several months later, SpaceX moved to start carrying small payloads at a discounted price. Mr. Beck also gave a warm tour of one of his factories to Chris Kemp, the CEO of Astra, who turned around and attempted to undercut Electron on price. Due to this, Mr. Beck has shifted his modus operandi, erring toward a tight-lipped strategy.

It’s important to note the difference between LEO, and larger launches Falcon 9 specializes in. SpaceX long ago decided to kill their LEO rocket, Falcon 1, leaving the market open to competition. Typically, LEO was government sponsored or military backed projects. Now, a plethora of private companies guide 10,000 satellites in low orbit, which are mostly used for communications: beaming broadband internet, GPS and direct mobile applications. And earth observations: radar tracking and climate change visibility. Looking at the earth, looking at people and tracking change. The number of LEO satellites will likely grow to 100,000; and probably far higher. LEO competition was initially thick, but RKLB has developed a clear edge.

Billionaires, Defense Primes & Peter Beck

Space rockets is an industry long dominated by extraordinarily wealthy men. Richard Branson’s Virgin Galactic. Elon Musk’s SpaceX. Jeff Bezos’ Blue Origin. There are exorbitant sunk costs needed to launch into orbit. It’s financial madness for all but a few. Governments can’t do it effectively for obvious reasons. Instead, they throw mountains of cash, which, despite the most exuberant defenses of impartiality, are increasingly politicized. The economics of the space industry has also shifted in favor of entrepreneurial firms. Historically, the federal government bid using cost-plus contracts. This incentivized drawn-out, above-budget outcomes from bureaucratic “primes” contractors like Boeing, Raytheon and Lockheed. Due to a number of lawsuits from private firms like Palantir and SpaceX, contracts have increasingly come in fixed-price form. Major defense primes once feasted on cost-plus contract structures, but launch has been democratized in a few short decades. Many primes are becoming component suppliers (instead of contractors). Now, SpaceX has a monopoly on large launches with their Falcon 9 rocket. The industry is at an inflection point. As global competition increases, so does the necessity for comprehensive space policy. As a result, in 2019, USSF and Space Development Agency were created, demonstrating the increasing importance the government is placing on freedom of space navigation.

One of the primary reasons to invest in RKLB is Founder, CEO and Chairman of the Board Peter Beck (47). His execution, engineering chops and steady hand are incredibly impressive. Blue Origin, SpaceX and RKLB all started around the same time. Back then, Bezos had way more money than Elon; and Mr. Beck was a complete unknown. Now, SpaceX has launched over 400 rockets, has four rocket families, is a leading satellite manufacturer and has put people into space. Blue Origin hasn’t flown a single satellite into space. Beck had far less money, started with almost no veteran people (because they couldn’t hire employees from defense primes) and was the least likely to survive. On July 17th, HBO released Wild Wild Space, which featured a number of companies competing in the LEO market. On a Reddit Q&A with the directors to stir up buzz for the release, Ashlee Vance, perhaps the most well-known space journalist in the world and author of When the Heavens Went on Sale, reserved extremely high praise for Peter Beck. “Peter came to rockets by building everything himself from his teenage years. He knows how to make an engine and a rocket and even the fuel himself.” He called him a, “one in a billion engineer” and, “perhaps the most gifted engineer I’ve ever seen.” “On paper, there is no way Rocket Lab should have worked.” Pete Worden formerly ran NASA’s Ames Center in Silicon Valley. He was the tech lead for Strategic Defense Initiative, which is commonly known in Washington as “Star Wars.” Worden was the key bureaucratic liaison in the democratization process, earning the affection of many young entrepreneurs with his leadership and good nature. Worden says of Beck, “He is one of the best engineers I have ever met.”

Beck grew up in a family of engineers and educators. His late father was a gemologist and telescope engineer. “One of my youngest childhood memories is standing outside in the night sky, looking at the stars and just wondering,” Beck said. “Unlike a lot of kids who wondered what they wanted to do when growing up, I knew I wanted to build rockets.” When he started, there was zero space industry in New Zealand. Beck just started building rocket engines himself, starting small, and growing bigger. His dream was to work for NASA, but he was a foreign national with no degree. So he quit his job and started RKLB. He’s now a one-man industrial policy for the nations’ space industry. Sporting curly hair, broad shoulders and a thick Kiwi accent, his journey since founding in 2006 has been nothing short of impressive. The company survived for years with little fresh capital, a testament to his grittiness, innovation, and endurance. Early on, they developed all kinds of stuff for clients, including a drone for front-line troops and a special rocket propellant partly funded by DARPA. Space rockets are notoriously hard to successfully develop and launch. Many have brought rockets to orbit a few times. Few have done it consistently. It takes unusually talented engineers to get them designed and working. A growing number of rocket startups have emerged in recent years. Few have moved past development and testing phases. Most start-ups fail.

Chad Anderson, who runs space venture capital firm Space Capital, says his firm has invested ~$30 billion in over a hundred launch companies over the last decade. Two have reached orbit: SpaceX and RKLB. Many years ago when looking for his first angel check in Silicon Valley, Beck was asked repeatedly, “How are you going to compete with Richard Branson’s Virgin?” Early on, Virgin Orbit (the launch subsidiary of Virgin Galactic) had over $1.2 billion poured into it. They never reached orbit; RKLB did it with $100 million. If you were running a book, the odds were never in favor of Mr. Beck. But he won. In classic karmic fashion, when Virgin Orbit went bankrupt, RKLB bought the facilities, leases and brought onboard many of their experts. Jeff Bezos’ second marriage has fueled a lavish life of yachts, Miami mansions and concerts. He isn’t a physics engineer, didn’t grow up dreaming of rockets and isn’t showing maniacal focus on Blue Origin. With orders of magnitude less capital, Beck is outcompeting Blue Origin. Valued north of $15 billion, Blue Origin has yet to reach orbit. Mr. Beck is the only non-billionaire entrepreneur competing at the upper echelons of the launch industry.

Political Game Theory, Rockets & Carbon Composite

Political game theory plays in Becks’ favor. SpaceX’s Falcon 9 holds a de facto monopoly over the large launch space right now. There is a brittle governmental reliance many in Washington disfavor. How many monopolies with such critical national security implications last very long? “Heaven forbid we have a mishap with a Falcon 9 launch,” said Col. Richard Kniseley, who helps run Space Force’s Commercial Space Office. The United Launch Alliance, a joint venture set up by Lockheed and Boeing, sent three rockets to orbit last year. The Washington Post reported Pentagon’s space procurement chief, Frank Calvelli, sent a critical letter to executives at Boeing and Lockheed, the co-owners of ULA who recently put the giant up for sale. “I am growing concerned with ULA’s ability to scale manufacturing of its Vulcan rockets and scale its launch cadence to meet our needs. Currently there is a military satellite capability sitting on the ground due to the Vulcan delays.” Calvelli wrote.

Elon remains an increasingly polarizing figure in Washington, yet the ability of the U.S. to reach orbit (including vital classified military and spy satellites) remains hugely dependent on him. Concerns escalated after he denied a request from Ukraine in 2022 to turn on Starlink coverage over Crimea so Ukraine could target Russian forces. Last month, a bipartisan group of 36 House lawmakers sent a letter to Frank Kendall, the Air Force secretary, urging him to make sure that the Air Force pushes for “increased competition among launch providers.” The transatlantic Western establishment has taken note of Beck’s impressive execution and steady demeanor. They are going to metaphorically knight him. In fact, that actually just happened. Meet Sir Peter Beck.

There are many indicators RKLB has become a favored ally of the establishment. Launch customers include NASA, USSF and DARPA. Three of the most desired customers in the industry. These contracts are validations from the most demanding clients in the game. USSF and the DoD becoming increasingly confident in RKLB’s launch capabilities is a huge deal. Board of Directors includes Michael Griffin, who served as President and CTO of In-Q-Tel, the venture capital arm of the CIA. He also did stints as a NASA administrator and worked in the Pentagon for the U.S. Department of Defense as the Under Secretary of Defense, Research & Engineering. Mr. Griffin was one of three men on Elon’s famous trip to Russia to buy intercontinental ballistic missiles, the failure of which turned into the impetus for SpaceX.

Earlier this year, RKLB was awarded a $0.5 billion contract by the Space Development Agency to design and build satellites. In June, the Department of Commerce provided up to $23.9M under the CHIPS and Science Act to create a more robust supply of space-grade solar cells that power spacecraft and satellites. RKLB is one of two companies in the U.S. that specialize in production of efficient and radiation resistant compound semiconductors called space-grade solar cells. This is notable because solar is the most expensive (and often has the longest lead time) product on a spacecraft supply chain. So in 2022, they bought SolAero for $80 million. As the U.S. expands their presence in space, particularly with LEO satellites, there is great need for space-grade solar cells. The cells power important U.S. space programs, such as missile awareness systems and exploratory science missions, including the James Webb Space Telescope, NASA’s Artemis lunar explorations, the Ingenuity Mars Helicopter, and the Mars Insight Lander. The origin story of their now in-house space-grade solar cells illustrates their quest for vertical integration through acquisitions. Space supply chains are largely subscale mom-and-pop firms. Many can’t handle large orders. When RKLB started building photon satellites in 2019, they ordered reaction wheels and star trackers from Simply Interplanetary. The problem was they closed their order book in August, so if you didn’t place an order by then, it would be a 21-month wait to get the product. Simply Interplanetary was RKLB’s first acquisition. They then scaled it from 150 to 1,000 reaction wheels a year. This process has played out a number of times. Within six months of being public in 2020, RKLB acquired four space components companies.

Beck did an outstanding job with the first rocket prototype, Electron. In early 2018, they broke the record by successfully launching on their second attempt. Electron has been flown 50 times (47 successes) and is the second most frequently launched rocket in the world (just behind SpaceX’s Falcon 9). SpaceX will launch 150 times this year (mostly Starlink). Electron once a month. The impressive engineering of Electron is worth noting. Electron’s Rutherford engine is the world's first 3D-printed, electric pump fed rocket engine. It provides efficiency in the small launch space, with a thrust-to-weight ratio exceeding traditional engines by 30%. The carbon composite airframe offers a fantastic strength-to-weight ratio, enabling a payload fraction of over 5%. This is a significant improvement over traditional metallic structures. Electron's carbon fiber composite airframe is proprietary manufacturing, which has resulted in a 40% weight reduction compared to aluminum alternatives. They also developed kick stage technology, which provides precise insertion capability, enabling deployments to multiple orbits in a single mission, a capability previously reserved for much larger launch vehicles. They recently successfully executed a complex mission that involved placing two satellites into different orbits during a single launch. While launching a rocket is extraordinarily hard, precisely delivering payload is even harder. In March, RKLB unveiled plans for a medium class, reusable rocket called Neutron. Able to carry 20 times the weight Electron can, Neutron is an entry into markets for mega-constellation launches, as well as future robotics missions to the moon and Mars. Neutron will also be designed for human spaceflight. Electron is for institutions on a budget like early start-ups, or lower priority civil and government missions looking to launch a one-off satellite or potentially demo a constellation. Over time, these may graduate into mega-constellation customers for Neutron. Neutron is sized to be able to launch ~90% of all spacecraft in development this decade. The industry is littered with graves of companies who either didn’t achieve product market fit, or did so with unsustainable or unfixable cash burn rates. Beck is trying to thread the needle. It goes without saying: he must deliver on Neutron in the next few years. This is what the market is focused on.

The carbon fiber advantage is worth note. A recent interview with Stoke Space CEO Andy Lapsa was interesting for a few reasons. He mentions one downside of carbon composite is it requires a lot of expensive fixed tooling in factories. Unit economics are unfavorable due to the relatively small number of units produced. You have very expensive machines sitting idle for long stretches. This is compounded by this fact: Neutron’s final iteration will have a vehicle capable of 20+ missions, resulting in even less use. Beck has planned for this; and the competition will struggle to copy him. This is because it requires a space systems and external composites business. Similar to their software business they sell to third parties, RKLB recently opened a composite business (for which they already have first customers). The growth of this internal business will result in lower manufacturing cost per carbon composite material. This flywheel will increase as RKLB scales. Pure play launch companies cannot copy this and are forced into other materials like stainless steel; or are forced to bear the cost of expensive machines sitting idle for a large period of time.

Bearish Thesis, Competitors & Electron

Much of the bearish RKLB thesis revolves around launch commoditization compressing margins and unknown space systems business strategy. There is a question as to how many LEO launch providers can market demand support. But it mostly boils down to fear of Elon. The market believes that, even if Neutron is successful, RKLB will struggle to compete with Falcon 9 and Starship. There are other competitors, like Firefly, Blue Origin, Stoke Space, Astra Space and Relativity Space. None are in the same league as SpaceX. The ~$220 billion SpaceX valuation is roughly two thirds Starlink, a third launch. The annual space market is roughly ~$20 billion launch, ~$35 billion spacecraft, ~$320 billion space services. So, SpaceX’s launch business is valued roughly triple the annual launch market. The market expectation is launch commoditization, with SpaceX dominating smaller firms on $/kg payload. This is an overly reductive narrative for a number of reasons. Electron fills a market niche no other provider can offer. It’s the lowest price dedicated ride to orbit. Not even Neutron will disrupt that. Right now, to get to LEO, your option is rideshare or Electron. People pick Electron because customers choose when they launch and where they go. Demand is sticky because there is much customization. Customers often rely on Electron because they designed their constellation (or spacecraft) around it. If discontinued, there will be many with nowhere to go. Price is not the only selling point.

In late June, RKLB announced a new deal with Synspective (a Japanese Earth observation company) covering 10 Electron launches. This is the largest Electron deal in history, signaling reliability as a launch provider. They have been the sole provider for Synspective since 2020. Last March, they successfully completed a launch for Synspective, and two other launches are scheduled for later this year (in addition to the newly announced 10 launches). This is illustrated in their 45 launch backlog, including a Global Star MDA contract for a 17 satellite constellation and a $515 million contract for 18 satellites for the Lower Orbit Proliferated Warfighter Space Architecture program for USSF. RKLB’s vertical integration and in-house capabilities won the Global Star MDA contract, which required a very large, complicated spacecraft, where schedule was as important as technical capabilities.

To be fair, RKLB is far behind SpaceX. They must master reusability, among many other things, for Neutron’s success. Unlike SpaceX’s Crew Dragon vehicle, RKLB isn’t building its own crew capsules. If Neutron takes humans into orbit, it's not clear what vehicles can launch on it. They aren’t building an interplanetary spaceship like Starship. RKLB’s only publicly announced big project outside of rockets is the Photon satellite bus (the infrastructure for the spacecraft that usually tells ground control where the satellite is in orbit). But limited public announcements of internal systems businesses is only indicative of Mr. Beck’s tight-lipped strategy. He has been burned by loose lips before. There is little reason to show his hand.

Customization & Starship

Examples of their sophistication and capability abound. In winter 2022, MDA Ltd, a Canadian space company, selected RKLB to develop the satellite operation control center (SOCCS) for Globalstar’s growing constellation. MDA is the prime contractor for Globalstar’s new Low Earth Orbit (LEO) constellation. The contract builds on the existing relationship between the three companies which was established in February 2022 when RKLB was awarded a $143 million dollar contract to design and manufacture 17 spacecraft buses for Globalstar’s new LEO satellites. Two spacecraft, designed and built exclusively by RKLB, are going to mars this year. When they arrive, 20% of everything in orbit around Mars will have an RKLB logo on it.

Here is an example of customization and vertical integration. A customer will ask to build a satellite or a spacecraft, in this case, Varda (a private company aiming to manufacture drugs in space). A bit of context: certain protein crystals grow far more purely without gravity. And the pharmaceutical industry is very interested. The customized spacecraft was almost entirely built in-house. All composite structures were. The radio. The propulsion system. The tanks. Star trackers, reaction wheels, solar panels. The battery. Software, too. There is almost nothing that wasn’t. They are second to only SpaceX in capability to innovate, come up with solutions and problem solve at great speeds. They launched the spaceship for Varda, held it in orbit for a number of months and re-landed it in the Utah desert. It was the world’s first space manufacturing mission conducted outside of the International Space Station.

Company Infrastructure & Launch Sites

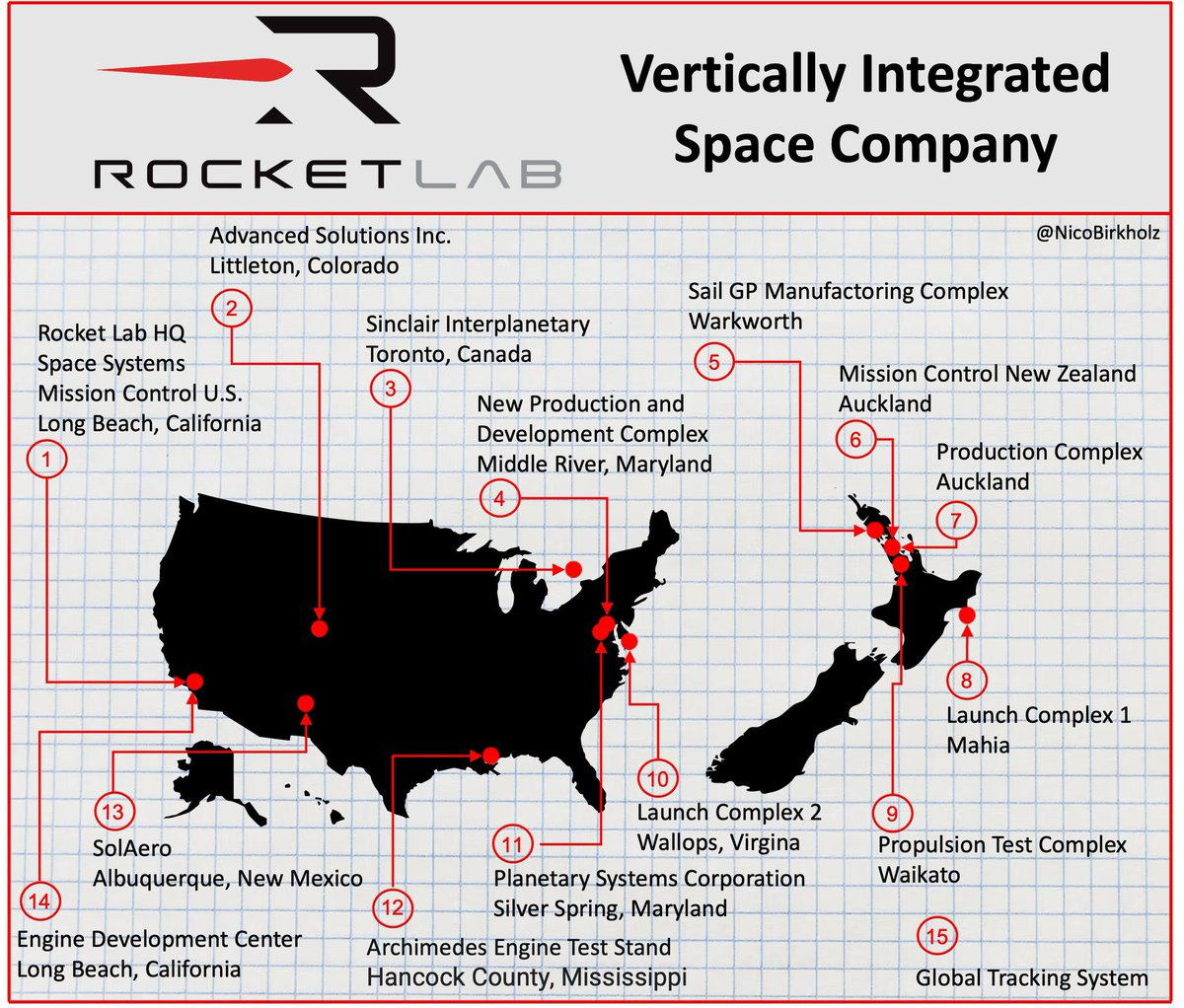

The CFO Adam Spice and Peter Beck joke that they spend all their money on concrete, steel and factories because of the enormous infrastructure costs needed to develop, design and launch rockets. 80% of the work and capital goes into factories, launch sites and test facilities in New Zealand and the U.S. 20% into rockets.

The Global HQ in Auckland, NZ has a mission control room and R&D and production facilities for both launch vehicles and spacecraft. In Maramarua, NZ there is a Rutherford assembly and test facility. In an ex-Virgin Orbit building in Long Beach, CA, RKLB has their U.S. headquarters. There is a mission control room, R&D and production facilities and the engine development center where Electron’s Rutherford and Neutron’s Archimedes engines are built in an end-to-end production line. They have a number of production facilities from acquisitions like the Sinclair Interplanetary building in Toronto, SolAero Technologies in Albuquerque, NM and Planetary Systems Corporation in Silver Spring, MD (among others). Sinclair is the expanded R&D and production facility for spacecraft components such as star trackers, reaction wheels, laser crosslinks and electronics. SolAero has the R&D and production of solar cells, panels and electronics. In Mississippi, they have the engine test facility for Archimedes. Their Middle River, MD factory has a very large automated fiber replacement machine, which functions like a giant 3D printer for large composite structures. When the rocket is ready, it gets conveniently put on a barge and rolled down to the Wallops Island launch site. Then, just outside Wallops Island, they have the integration facility that does the final assembly of the launch vehicle. The Wallops-area infrastructure is indicative of the sound long-term chess Beck is playing. There is already jostling between Blue Origin and SpaceX over the worlds’ busiest launch site: prized Cape Canaveral, FL. Instead of competing with heavyweights, Beck is the big fish at Wallops.

They also wholly own the only operational, private orbital launch site in the world in Mahia, New Zealand. This is a huge competitive advantage given the flexibility — it can support launches every 72 hours — and autonomy it provides. Beck had to build roads, install air blown fiber systems and establish internet capability to entire townships to construct and support Mahia. While such an illiquid and unique asset is difficult to value, there is a case to be made that Mahia is worth billions. One of the primary reasons launch is difficult in the U.S. is the level of air traffic in American skies. When SpaceX’s Falcon Heavy launched, 562 airline flights were delayed. The FAA had to shut down a large swath of airspace for more than three hours, stretching the Florida coast 1,300 miles east over the Atlantic. Flights up and down the busy Eastern Seaboard had to go around the safety zone, causing delays and forcing additional fuel burn. Disrupting air travel does not scale well in America. There is also jostling between big players like Blue Origin and SpaceX at prized launch sites. An isolated, island nation is ideal geography to launch rockets into orbit multiple times per month. New Zealand also happens to be a geostrategically critical country. The remote and unique geography allows satellite observation and communication not possible from other places. This makes the country both valuable (and vulnerable) in any large-scale conflict. It’s also a favored location of the elite class to escape doomsday scenarios. It has been quietly added to a U.S. military trade law (essentially making the country a protectorate of the U.S.). This enables free-flow of U.S. military assets, technologies and personnel into New Zealand entities. New Zealand is now a partner (along with Five Eyes allies Britain, Australia, Canada, France and Germany) with USSF, part of the overall U.S. Armed Forces. RKLB is a huge beneficiary of this; I believe the passing of the law was partly fueled by their momentum.

Conclusion

When most think of space, they think of SpaceX and Elon. Then, maybe Bezos and Blue Origin. In reality, RKLB is in second place in the space race. When Elon has faced fierce competition, he comes back with his opponents head on a platter. Lots of money is on the sidelines due to this. What sane investor wants to bet on someone winning market share from him? Many of the largest and most sophisticated fund managers on earth hold this belief. So do most retail investors. Therein the reductive mainstream narrative lies opportunity. The apples-to-apples $/kg “SpaceX will destroy RKLB on payload margins'' comparative analysis is wrong for two simple reasons: 1) sticky demand from customization of spacecraft and satellite 2) political game theory. Electron provides unparalleled efficiency in the small launch LEO market. It remains the cheapest, most precise way to enter LEO. And Elon is the antithesis of the stale Martha's Vineyard and Nantucket class. Given the immense military and strategic applications of space, the establishment will want more than one option.

It’s important to remember: it’s still incredibly difficult to get to orbit. Roughly 92% of the rocket is propellant. The payload is generally ~5% or less. Physics still slaps humans around. It will never be like an airline ticket. Rockets are the keys to space, not the moneymaker. Companies choosing to forgo this difficult task will rely exclusively on launch providers to conduct business. Those who control the keys have great power and opportunity, regardless of short-term profitability. RKLB is the 2nd best launch company in America. The grin that crosses Mr. Beck’s face when asked about the competitive position of non-launch companies betrays the tricks up his sleeve. Q2 2024 earnings were just announced for August 8th. It will likely be their first $100 million dollar quarter. 77% YoY revenue growth; 18% QoQ. Space systems revenue is estimated just shy of ~$80 million, and around ~$28 million for launch. The company had $1.02 billion in backlog. Roughly $216 million of this consists of the launch backlog, with the remaining coming from Space Systems.

RKLB’s advantages: squeaky clean, genius Founder and CEO with 10+ year experience in materials sciences, specifically in working with carbon fiber which has been battle tested over fifty launches. RKLB is the only company to have shown significant progress on carbon composite structures. Flight and navigation and guidance systems and software that have been proven to work. The knowledge and experience to operate launch sites including wholly operating the Mahia site for seven years. This gives the U.S. team a blueprint for America and elsewhere. An experienced mission control center ( which has facilitated 47 successful Electron launches). RKLB’s capabilities are increasingly trusted by the USSF and DoD. They have over 240 open job listings; some of which require secret DoD clearance. The half billion dollar contract won at the beginning of the year is a small appetizer. What the federal government likely wants out of RKLB will result in tens of billions of contracts. It would not surprise me if RKLB wins massive contracts to establish operations in other geostrategic countries (like Australia). In fact, RKLB just opened an Australian subsidiary to prepare to do business there.

I believe it’s a good buy at ~three billion dollar valuation and under. While unprofitable, It's not a stretch to see the business generating free cash flow in coming quarters as revenue rises. They would be quite close to profitability without massive Neutron investment. The progress of Neutron, dilutive capital or debt transactions, internal space system business initiatives, contract announcements, acquisitions, durability of Electron demand, profitability and competitive landscape are all catalysts to watch. In summation: it’s the second most innovative end-to-end space company on earth, the second best launch company in America, helmed by a squeaky clean engineering genius who was just knighted, one of two firms that specialize in space solar cell production, industry leader in composite space structures, increasingly vertically integrated and maintain the only operational, private orbital launch site in the world located in a strategically critical country. And is quickly advancing as an important supplier to the American military. It's an increasingly critical national security asset trading for ~$2.6 billion. What are the businesses RKLB could do one day? LEO space traffic management. Space debris clearance. Data tracking. Robotics missions. Offensive and defensive military maneuvers. On top of their current ones: components businesses in materials and software. Launch. Customized satellites and spacecraft. It’s a baby, futuristic space Northrop Grumman. RKLB is the rough equivalent of a private contractor for American space special forces combat engineering corps. And the space wars have yet to begin.

Excellent well balanced write up (with bullish and bearish factors)! Mind a suggestion from me for your kind consideration, do a few other writeups on RKLB's competitors (Can be bullish and bearish on them). It helps to bring different investors perspectives.🙂

Disclosure:

1,800 shares @4.657 avg price.

Great writeup! Curious to hear your thoughts on their addressable market in dedicated launches & gov't. They have a tech advantage vs startups & politics in Washington in their favor--great setup to become a big #2 player in the industry--but I question how big the TAM can physically get, given a lot of commercial demand will be taken by SpaceX by virtue of being cheaper (I reckon Starship could be in service before Neutron if RKLB has issues scaling carbon fiber for Neutron). They'll get gov't contracts but idk if that can justify their valuation at this point in time. Thanks!